Leverage

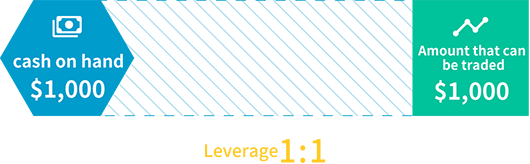

Leverage can be traded in a larger amount than the actual funding.

Even beginners use 1000 times more high leverage that can start with a small amount of money.

If you do a large transaction with a small amount of money, there is a risk of loss, but the IS6FX uses a zero cut system that does not cause any loss than the margin balance, and the leverage is fluctuated based on the account balance, and the customer's assets are used. We are protected.

Leverage benefits

By making a large amount of money with a small amount of money, you can make a big profit and increase your financial efficiency.

About leverage of IS6FX

IS6FX leverage standard is 1000 times, but it depends on some account types.

In addition, leverage fluctuates according to the account balance and the transaction amount of some brands (all cryptocurrency brands).

Please check the fluctuation rules before trading.

Changed leverage by balance

Standard / Micro / EX / Crypto

| Account balance | Leverage |

|---|---|

| $20,000less than | 1000times |

| $20,000More than | 500times |

| $50,000More than | 200times |

| $100,000More than | 100times |

Leverage change based on effective margin

Zero

| Account balance | Leverage |

|---|---|

| Uniform fixed regardless of the balance | 200times |

Changed leverage by transaction amount

Only cryptocurrency brands have a dynamic leverage in which leverage fluctuates by transaction amount, and leverage changes due to balance are not applied.

Leverage 2000 times Forex

| Transaction amount | Leverage |

|---|---|

| $0 ~ $200000 | 2000times |

| $200000 ~ $800000 | 1000times |

| $800000 ~ $1500000 | 500times |

| $1500000 ~ $2500000 | 200times |

| $2500000 ~ | 100times |

Leverage 2000 times Metal

| Transaction amount | Leverage |

|---|---|

| $0 ~ $200000 | 2000times |

| $200000 ~ $400000 | 1000times |

| $400000 ~ $1000000 | 500times |

| $1000000 ~ $2000000 | 200times |

| $2000000 ~ | 100times |

BTC / BCH / ETH / XRP / LTC

| Transaction amount | Leverage |

|---|---|

| $0 ~ $5000 | 1000times |

| $5001 ~ $10000 | 800times |

| $10001 ~ $50000 | 400times |

| $50001 ~ $100000 | 100times |

| $100001 ~ | 20times |

ADA / XLM

| Transaction amount | Leverage |

|---|---|

| $0 ~ $3000 | 1000times |

| $3001 ~ $10000 | 500times |

| $10001 ~ $20000 | 200times |

| $20001 ~ $50000 | 100times |

| $50001 ~ | 20times |

DOT / BNB / DSH / EOS / TRX / DOG / SOL / AVX / LUN / XTZ / LNK / UNI / MAT / COM / ENJ / CHZ / THT / MAN / AAV / ALG / AXS / BAT / GRT / KSM / ZRX / OMG / SKL / SSS / STR

| Transaction amount | Leverage |

|---|---|

| $0 ~ $10000 | 50times |

| $10001 ~ $20000 | 20times |

| $20001 ~ $50000 | 10times |

| $50001 ~ $100000 | 5times |

| $100001 ~ | 1times |

Explanation of dynamic leverage

What is dynamic leverage?

Dynamic leverage is a mechanism that calculates margin in stages based on the trading amount of the position.

Traditional leverage applies a fixed amount of leverage, while dynamic leverage applies different leverage depending on the trade amount.

Example:USDJPY

Let's say you have a position of 3 lots ($300,000) in USDJPY. This amount usually corresponds to 1,000x, but the actual margin calculation is as follows:

- The first $200,000 is calculated by 2,000x.

- The remaining $100,000 is calculated by 1,000x.

In this example, the required margin is $200, which equates to an overall leverage of 1,500x. Dynamic leverage flexibly adjusts margin requirements to provide the right leverage depending on position size.