“Overseas forex is dangerous, so it’s better to quit.” Even now, such information continues to circulate. If you are well-versed in forex, it may be fine, but beginners in forex will likely feel uneasy.

This time, to resolve those concerns, I will explain whether “overseas forex is truly dangerous.” We have also summarized common misunderstandings, risks, and ways to control dangers, so please use this as a reference.

The truth is, the danger of overseas forex is very low

It is often said that “forex is highly risky,” but in reality, it is not such a high-risk investment. This is because you can control the risk yourself. If you properly manage the risk, you can trade relatively safely with low risk. It is important not to be misled by biased information and to carefully consider “whether it is truly dangerous.”

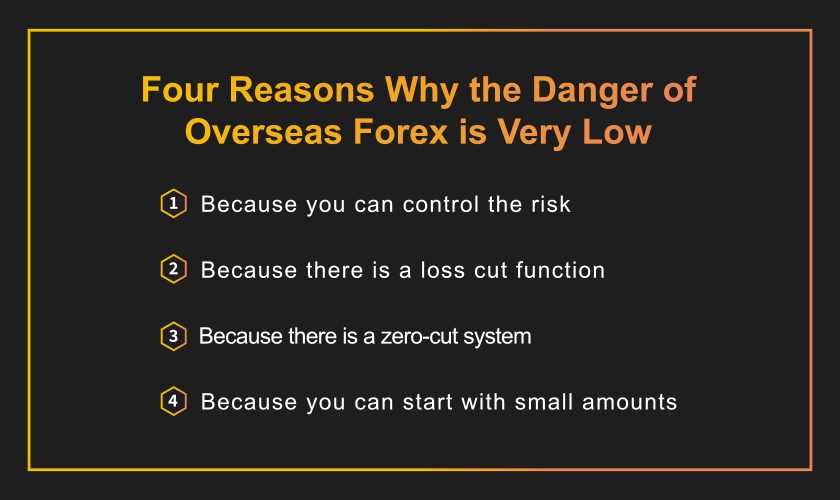

Four reasons why the danger of overseas forex is very low

One reason why the danger of overseas forex can be considered low is the presence of a loss cut function. Other reasons include the introduction of the zero-cut system and the ability to start with small amounts. Here, I will explain these reasons why the danger of overseas forex is low.

1. Because you can control the risk

The first reason is “because you can control the risk.” For example, overseas forex has a feature called leverage. Leverage is a system that allows you to trade as if you have more funds than the investment amount you have deposited. Leverage affects not only the investment amount but also profits and losses. At this time, if you apply leverage of 100 times, the loss will also increase 100 times, making the risk higher.

However, what if you use leverage of 3 times instead? It would allow for safer trading than with 100 times leverage. In this way, overseas forex allows you to control the risk yourself. Understand your own tolerance and set the risk accordingly.

2. Because there is a loss cut function

The second reason is “because there is a loss cut function.” The loss cut function is a system where, if you incur a certain percentage of loss as determined by the forex broker, your positions are forcibly closed. For instance, if Forex Broker A sets the stop-loss ratio at 20% and your investment amount is 100,000 yen, the loss cut will be executed when you incur a loss of 80,000 yen.

At first glance, this may seem like a negative system, but thanks to the loss cut function, traders can avoid losing their entire assets. Of course, there are exceptions, but with the loss cut function, you generally won’t lose all your funds.

3. Because there is a zero-cut system

The third reason is “because there is a zero-cut system.” The zero-cut system is a mechanism that resets losses exceeding your assets to zero. For example, suppose you have an investment amount of 1,000,000 yen and incur a loss of 1,500,000 yen. Normally, since the loss exceeds your investment amount, you would have to pay the shortfall of 500,000 yen.

However, if the forex broker has implemented the zero-cut system, the broker will cover that 500,000 yen. With this system, you won’t go into debt due to forex losses. However, note that the zero-cut system is only implemented by overseas forex brokers.

4. Because you can start with small amounts

The fourth reason is “because you can start with small amounts.” This advantage allows you to “keep losses small.” For example, suppose you invest 1,000 yen. If the market moves 30% against your prediction, which is a rare and significant event, your loss would only be 300 yen since you only invested 1,000 yen.

This way, even if you incur a loss, it won’t be overwhelming. Since you can start with just a few hundred yen, overseas forex is accessible even to those who can’t prepare large sums of money.

Common Misconceptions About “Overseas FX = Dangerous”

There are misconceptions that overseas FX is dangerous due to high leverage, risks of losses, or fears of debt. However, without accurate knowledge, losses can occur, so caution is needed. This section explains common misconceptions about the perceived dangers of overseas FX.

High Leverage Is Dangerous

The first misconception is that high leverage makes overseas FX dangerous. While it is true that overseas FX allows high leverage—up to 1,000 times—it is up to the trader to decide how much leverage to use. If you believe high leverage is risky, simply lower the leverage.

Risk of Losses Is Dangerous

The second misconception is that the risk of losses makes it dangerous. While it is not incorrect that losses are possible, no business is free from risk. Even in ventures like selling goods or running ads, there are risks of loss. Part-time jobs may not involve monetary loss, but they trade time, which could be seen as a form of loss.

In any activity, something is always consumed. Instead of fearing losses, think about how to minimize them.

Fear of Debt Is Dangerous

The third misconception is the fear of debt. Overseas FX has a loss cut feature, so debt is generally not an issue. However, for those who are worried, consider using an FX broker that offers a “zero-cut system.” With this system, the maximum loss is limited to the amount of your deposited funds.

It’s Dangerous Because It’s Overseas

The fourth misconception is that it’s dangerous simply because it’s overseas. This fear can be alleviated by checking for a registration number. Brokers with a registration number are registered as international business companies (IBCs). This registration demonstrates they are authorized to operate by their country, so choosing such brokers ensures safer transactions.

Investing Is Dangerous

The fifth misconception is that investing itself is dangerous. If that were true, investments would be banned altogether. Recently, governments are actively promoting investment tools like iDeCo and NISA. These developments show that investing is not inherently dangerous. When done with proper risk management, investment can be a tool to enrich your life.

Brokers Might Go Bankrupt

The sixth misconception is the fear of brokers going bankrupt. Bankruptcy risk exists even in stable companies, so worrying about it has no end. To mitigate this risk, avoid putting all your assets in a single FX account. Diversifying assets reduces the risk of loss due to bankruptcy.

Let’s Understand the Risks of Overseas FX

While the dangers of overseas FX may be minimal, there are risks involved. Starting trading without understanding these risks can lead to unexpected failures. Below are the risks you should be aware of to avoid dangers.

Exchange Rate Fluctuations

Exchange rate fluctuations are unavoidable in FX trading. Minimize this risk by starting with small amounts or using low leverage. Trading at night, when markets are volatile, is also not recommended for beginners.

Interest Rate Changes

Interest rate changes can affect swap points for held positions. While short-term traders may not need to worry about this, long-term traders should keep it in mind.

System Errors

System errors can prevent orders from being processed correctly. Although brokers have strengthened their systems, such risks, while rare, still exist.

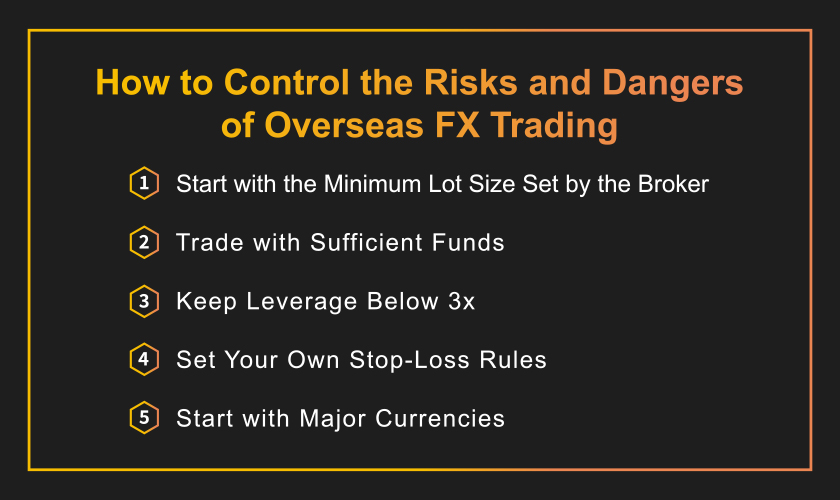

Methods to Control the Risks of Overseas FX

Overseas FX risks and dangers can be managed by starting with the smallest lot size, maintaining a financial cushion, or limiting leverage to 3x or lower. Below are methods to control such risks effectively.

Start with the Minimum Lot Size Set by the Broker

The first recommendation is to begin trading with the smallest lot size defined by the broker. The main advantage is that losses can be minimized. With proper control, losses can be limited to just a few hundred yen.

Trade with Sufficient Funds

The second recommendation is to trade with sufficient funds. Ideally, limit trading to 1/10th or 1/20th of your total investment capital. By doing so, you can significantly reduce your risk. This approach has been proven effective, with some traders earning hundreds of millions of yen using this method.

Keep Leverage Below 3x

The third recommendation is to limit leverage to 3x or less. Start with low leverage as a beginner. This allows you to keep losses low while gaining knowledge and experience. Once you’ve built up a solid foundation, you can gradually increase leverage. This is a proven method for improving your trading skills, so be sure to adopt it.

Set Your Own Stop-Loss Rules

The fourth recommendation is to establish your own stop-loss rules. Doing so can prevent significant losses. In overseas FX, it is more important to focus on avoiding losses than simply winning. Having a personal stop-loss rule is essential. It’s best to set these rules as a percentage of your balance. For example, you might decide to cut your losses when they reach 3% of your account balance.

Start with Major Currencies

The fifth recommendation is to begin trading with major currencies like USD/JPY or EUR/USD. Major currencies have relatively stable price movements, reducing the likelihood of significant losses.

On the other hand, minor currencies like ZAR/JPY (South African Rand) or TRY/JPY (Turkish Lira) are highly volatile. They carry the risk of incurring substantial losses in a short time, so they are not recommended for overseas FX beginners.

Summary

This guide explained that the risks associated with overseas FX are relatively low. Although the misconception of “overseas FX = dangerous” persists, it is not accurate. With the right knowledge and risk control, you can trade with low risk while managing your assets effectively.

We also introduced methods to control risks. While it may be challenging to adopt all of these practices at once, start by implementing the ones that are easiest for you.