In Forex (FX) trading, a “position” refers to holding a currency pair. If you want to make a profit in FX, you must establish a position. The way you take positions can significantly affect your profits, so anyone who wants to succeed in FX should ensure they have the necessary knowledge.

In fact, nearly all professional traders are skilled at taking positions. This article will explain the basic knowledge of positions, how to establish them, and important points to consider when doing so. It aims to resolve any concerns you might have regarding FX positions, so it’s a great reference for your studies.

What is a Position in FX?

A position refers to what is commonly known as a “trade” or “holding.” However, in FX, we use the term “position.” The positions come from either purchasing currencies or short-selling them. The term “玉” (tama) refers to foreign currency. When you purchase a currency, it’s referred to as “going long,” while selling it is called “going short.” Therefore, in FX, we say “to build a position” when establishing a trade. The phrase “holding a position” is also acceptable.

The basic types of positions in FX trading are “long” and “short.” When you purchase a currency, you take a “long” position, while when you short-sell, you take a “short” position. Additionally, there are positions referred to as “square” and “net.” I will explain the characteristics of each position, so please use this information as a reference.

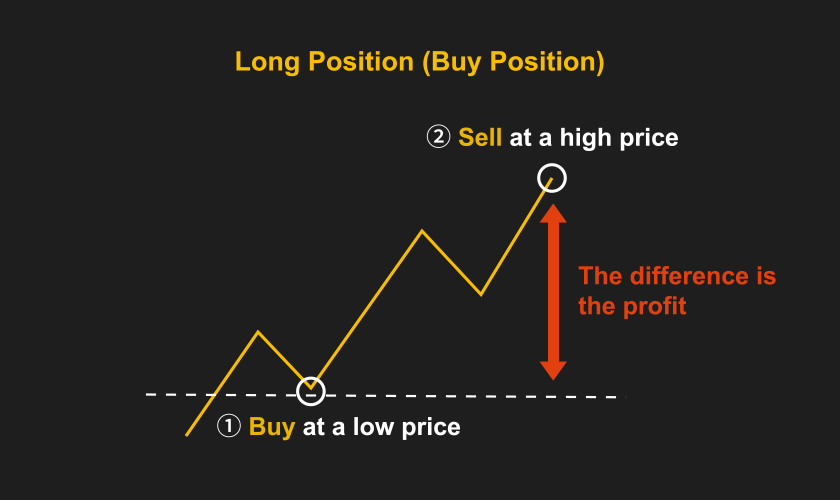

Long Position (Buy Position)

A long position refers to the act of purchasing and holding a currency. It is also known as a “buy position.” When you hold a long position, your profits increase as the chart rises from the price at which you bought the currency. To maximize profits, it is advisable to identify trend reversals or pullbacks and hold long positions as close to the bottom as possible.

A recommended strategy is to target the “London session,” which operates from 4 PM to 2 AM (or 5 PM to 3 AM during winter time). This period sees aggressive investors entering the market, often leading to trend formation. It’s important to determine whether an uptrend or downtrend is forming and enter in the same direction. Conversely, if the chart declines from the price at which you bought, you will incur losses, so be cautious.

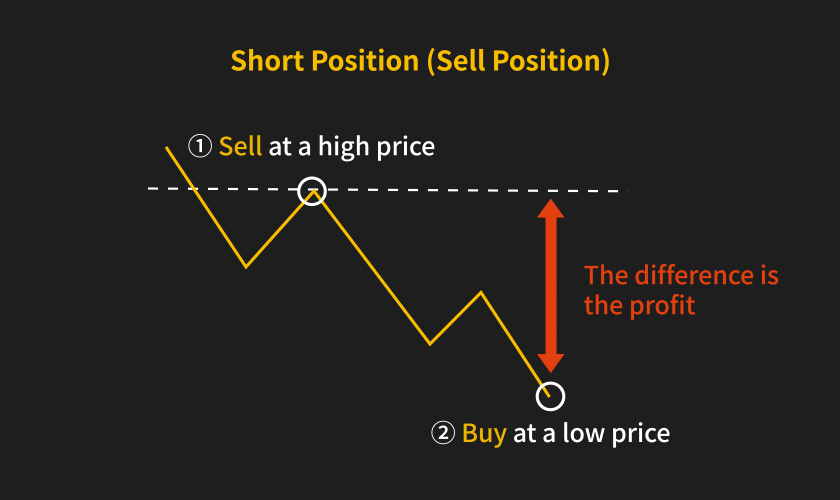

Short Position (Sell Position)

A short position involves selling a currency short and holding it. It is also known as a “sell position.” In a short position, you profit when the chart declines from the price at which you sold the currency. To maximize profits, aim to enter near the peak after identifying trend reversals. However, if the chart rises, you will face losses, so be mindful of positive news and economic indicators.

Compared to long positions, short positions tend to move more quickly. This means you can potentially gain significant profits in a short time if all goes well. However, it also carries the risk of incurring large losses quickly. For those who cannot afford too much risk, it’s advisable to set strict stop-loss orders and keep your lot size and leverage low.

Square Position

A square position refers to a state where you have no positions or have closed your positions. Similar terms include “no position” and “flat position,” all of which mean the same thing. When you execute a hedged position (holding both a long and a short position of the same quantity), it is also referred to as “squaring.”

In a square position with a hedged setup, your position’s profit and loss do not fluctuate; however, you will still incur costs from the spread and swap points. If you’re planning for a long-term square position, be cautious not to incur losses from spreads or swap points. A square position is used when you’re uncertain about the market direction. Once you see movement in the market’s direction, you can close one of the positions to take advantage of potential profits.

Net Position

A net position refers to the “pure position” after subtracting the short positions from the long positions in the same currency pair. It indicates your current net holdings. If the remaining balance after subtraction is positive, it is referred to as a “long position”; if negative, it is a “short position.” For example, if you hold a long position of 5 lots and a short position of 1 lot, your net position would be 4 lots.

If you’re only holding one side of the position and the market moves against you, you might feel anxious about the growing unrealized losses. In such cases, establishing a position in the opposite direction can help mitigate significant unrealized losses.

How to Establish a Position

To trade in FX, you need to hold positions. The act of holding a position is referred to as “building a position” in FX terminology. This is a necessary step to achieve profits, so let’s learn how to establish positions. This guide will be structured to ensure that even someone hearing about FX for the first time can confidently place an order.

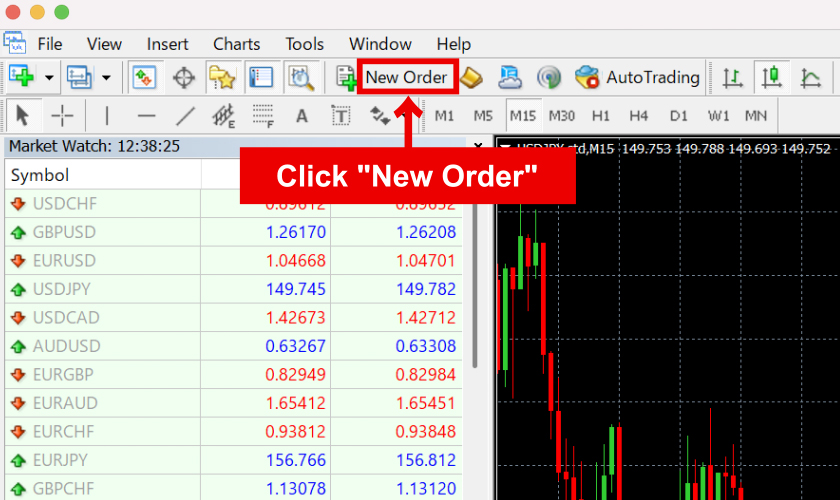

STEP 1: Place a New Order

To establish a position in FX, you need to purchase a position from an FX exchange. Start by navigating to the order page of your chosen exchange and select “New Order.” Launch “MT4/MT5,” and click on “New Order” located in the middle of the menu bar. This will bring up the order screen.

STEP 2: Select Currency Pair

Once the order page is open, the first step is to select your “Currency Pair.” A currency pair refers to the currencies you will be trading, such as “USD/JPY” or “EUR/USD.” It is recommended for beginners to start with major currency pairs like USD/JPY or EUR/JPY because they have high trading volumes and stable markets. Additionally, they often feature narrow spreads, which is an attractive aspect.

STEP 3: Choose Quantity

After selecting the currency pair, the next step is to choose the “Quantity.” This is typically expressed in “Lots.” For example, you might choose 0.1 lot or 1 lot. The size of a lot varies depending on the exchange you are using. Some exchanges set 1 lot as 10,000 units, while others set it as 100,000 units. Therefore, before placing an order, confirm the lot size set by the exchange you will be using. For FX beginners, it’s advisable to start with the minimum lot size, such as 0.01 lot or 0.1 lot.

STEP 4: Select Order Type

Once you’ve chosen the currency pair and quantity, the next step is to select the “Order Type.” In FX, there are mainly four types of orders.

| Order Type | Meaning | Details |

|---|---|---|

| Market Order | Immediate Order | Hold a position at the current price |

| Buy Limit | Buy Limit Order | Buy when the price drops below the current level |

| Sell Limit | Sell Limit Order | Sell when the price rises above the current level |

| Buy Stop | Buy Stop Order | Buy when the price rises above the current level |

| Sell Stop | Sell Stop Order | Sell when the price drops below the current level |

For FX beginners, it is recommended to use the Market Order type. It is simple and easy to understand.

STEP 5: Choose Buy or Sell

After selecting the order type, the next step is to choose either “Sell” or “Buy.” Depending on the FX exchange you use, red usually represents “Sell” and blue represents “Buy.” Clicking on either option will complete the new order. Check the trading screen to confirm that your position has been established. The numbers above “Sell” and “Buy” indicate the price at which you can currently buy. Be careful, as this is the price at which you will hold the position.

For Limit Orders: After Execution

Execution means that your order has been fulfilled, and you can hold the position. A market order executes the moment you press the sell or buy button, typically within seconds. However, limit orders can have significant delays from when you place them to when they are executed. Orders placed are merely “reservations,” and until the specified price is reached, the order remains “pending.” It’s possible for limit orders to remain unexecuted for weeks or months, so be cautious.

How to Close a Position

Many people understand how to establish a position, but simply holding a position doesn’t yield profits. To earn profits, you need to “close” the position. Here’s a straightforward explanation of how to close a position. It’s easier than establishing a position, so don’t worry.

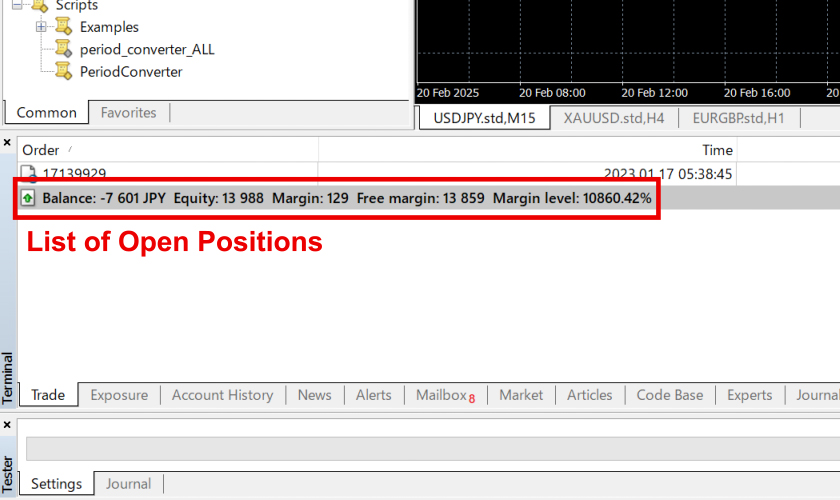

STEP 1: Open the Trading Tab

To close a position and realize profits or losses, first click on the “Trading Tab” from the icons at the top of the terminal. This will display a list of your currently held positions at the bottom of the screen. Depending on your exchange, you may also be able to view your held positions directly from the chart or trading screen.

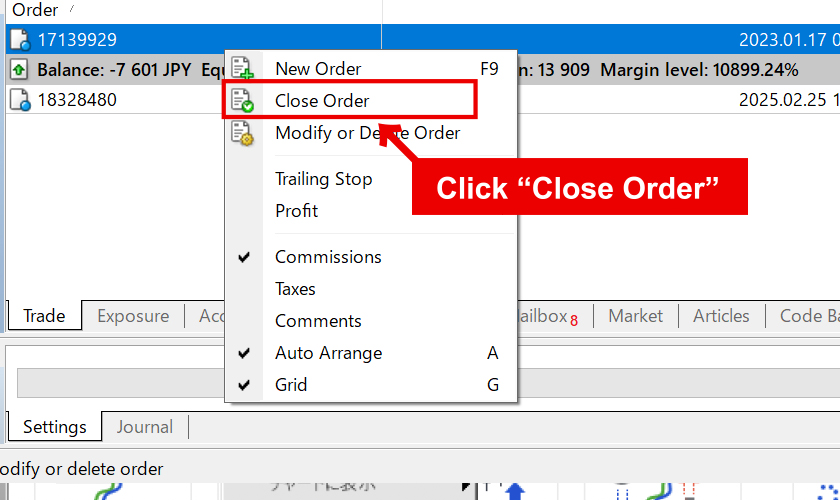

STEP 2: Click “Close Order”

After clicking the Trading Tab and seeing your list of held positions, find the position you wish to close. Hover your mouse cursor over it, right-click, and a menu will appear. Click on “Close Order.” Once you click, if the selected position disappears from the list, you have successfully closed it.

Holding Without Closing

In FX, it’s typical to place an order and then close it. Many traders adopt this method to aim for profit from price differences. However, holding a position can also be a strategy. If you hold a position for over a day, you will earn daily swap points during that time. These can also count as profit, so holding for longer might yield returns exceeding your trade differences.

How Long Can You Hold a Position?

If you’ve traded other financial products before, you might wonder about the holding period for positions in overseas FX. For example, stock trading allows a maximum holding period of 6 months, while futures trading allows 1 year. Holding a position longer requires closing it and reordering, which can be cumbersome.

In overseas FX, there are no such holding period restrictions. Positions can be held for a long time thanks to an automatic rollover mechanism. Rollover means extending the settlement date for open positions. Rollover does not incur additional costs, and you can close your position whenever you wish.

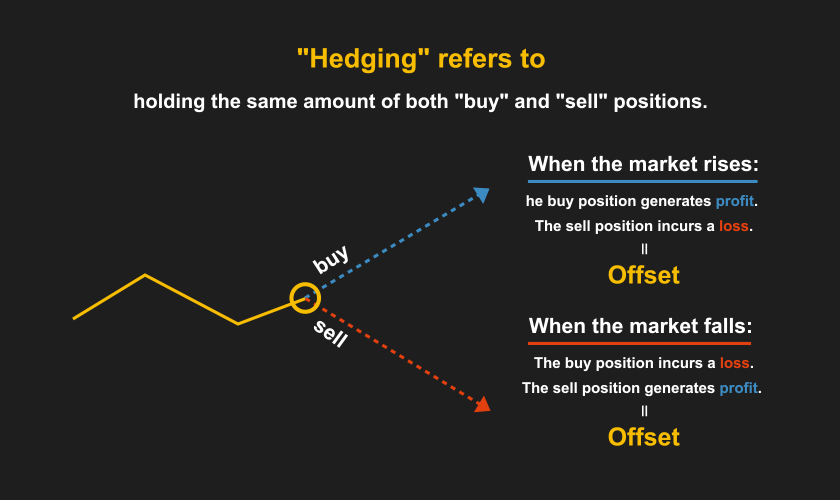

Method to Mitigate Risk: Hedging

Holding a position in FX involves certain risks, and it’s better to keep those risks low. One effective method is “hedging.” Hedging involves holding both buy and sell positions of the same quantity. This way, your positions offset each other, preventing any increase in unrealized losses during the hedging period. Hedging is recommended in the following situations:

When you cannot predict market movements

When important economic indicators are about to be announced or significant statements from officials are expected

When you have unrealized losses

When you want to target swap points

However, while hedging is in place, unrealized profits will not increase. Since you cannot win by just holding positions, you need to find the right timing to unwind your hedge.

Be Aware that Some Overseas FX Brokers Do Not Allow Hedging

First, note that some overseas FX exchanges prohibit hedging. Engaging in hedging at a broker that forbids it could result in account suspension. If your account is frozen, you risk losing any profits you’ve earned. Rules vary by broker, so always check the terms of service before using an exchange. For example, IS6FX allows hedging “only within the same account.” However, the following types of hedging are prohibited:

Hedging with multiple accounts

Hedging with similar currency pairs

Hedging that exploits system loopholes

If you practice hedging correctly, you won’t violate any regulations. Avoid gray-area methods for safety.

Seven Points to Note When Establishing Positions

Anyone can easily establish a position. However, due to this simplicity, some may enter positions carelessly. Being careless increases the likelihood of losses, so be cautious. To prevent significant mistakes, here are seven important points to consider when establishing a position.

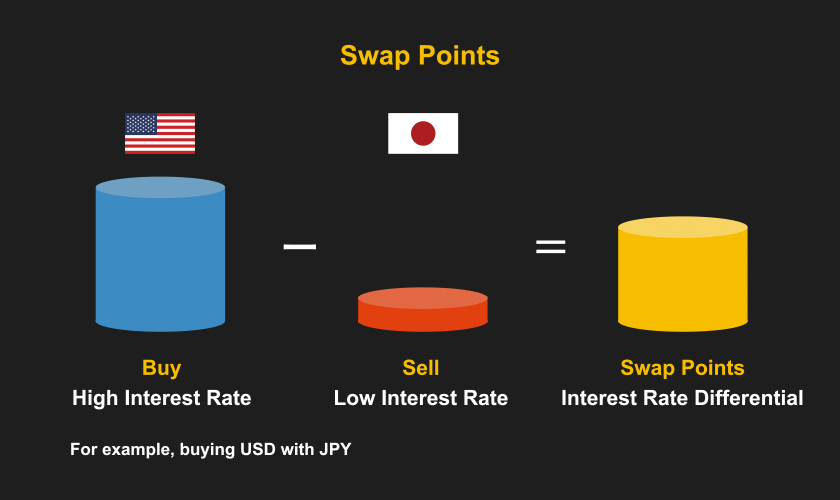

Be Careful of Negative Swap Points

Swap points refer to the interest rate differential of currency pairs. As previously explained, holding a position for more than a day can earn you swap points. If accumulated effectively, these can lead to substantial profits. In fact, some professional traders primarily rely on swap points for income. However, traders may also have to pay negative swap points to overseas FX brokers.

There are no advantages to holding negative swap points; they only lead to increasing losses. If you continue to hold a position, always choose one with positive swap points. You can check whether swap points are positive or negative on each FX broker’s official website.

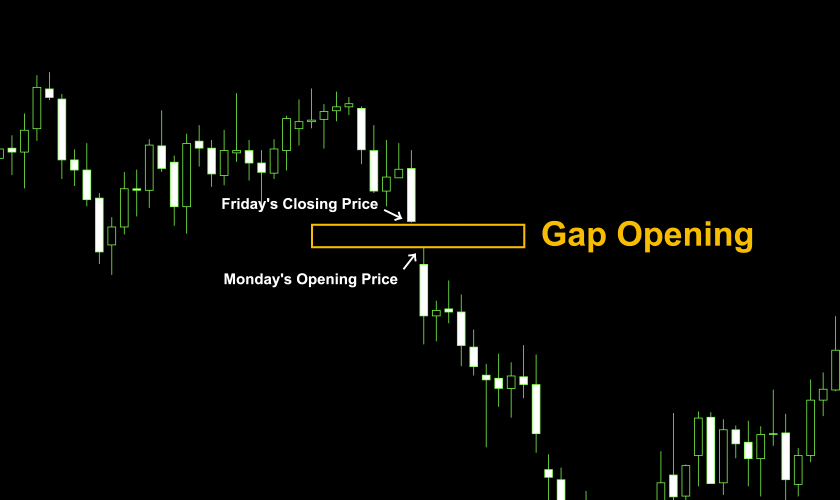

Do Not Hold Positions Over the Weekend

While there are successful strategies that involve holding positions for extended periods, it’s advisable for beginners to close positions by Friday night. Holding positions over the weekend risks encountering gaps when the market opens on Monday. The forex market only moves on weekdays, with weekends being inactive.

If a significant event occurs over the weekend that impacts the market, the market may open in chaos on Monday, leading to potential losses. Holding positions over the weekend is riskier than the potential returns. Until you develop a level of risk management and market analysis skills, it’s better not to hold positions over the weekend.

Beware of Excessively High Leverage

One of the attractions of overseas FX is the ability to use high leverage. While domestic FX allows a maximum leverage of 25 times, IS6FX permits up to 6,000 times. High leverage enables you to aim for substantial profits with minimal capital. However, high leverage also amplifies losses.

For those just starting in FX, experiencing a 6,000-times loss can be quite psychologically taxing. Therefore, rather than jumping straight into high leverage, begin trading with lower leverage. A leverage of around 3 times is recommended. As you become more accustomed to trading and market movements, you can gradually increase your leverage.

Understand the Disadvantages of Market and Limit Orders

The downside of market orders is that they are prone to “slippage.” Slippage occurs when there’s a discrepancy between the rate at the time of the order and the rate at execution. When slippage occurs, traders may find themselves in an unfavorable position. This risk applies not only at the time of order but also when closing a position with a market order.

To avoid slippage, consider using limit orders. However, keep in mind that limit orders can lead to missed trading opportunities because they only execute when the specified price is reached. Therefore, set your limit order price close to the current rate to minimize this risk. Both order types have their pros and cons, so choose according to market conditions.

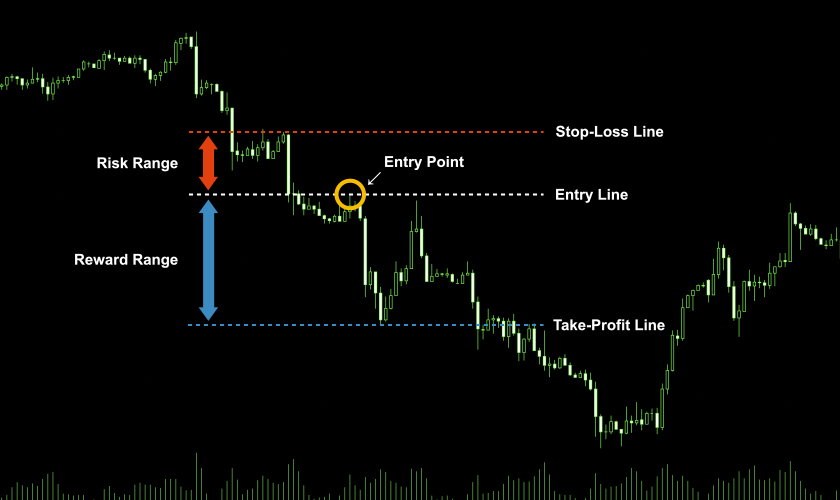

Set a “Stop-Loss Line”

Continuing to hold a position that is moving against you, resulting in growing unrealized losses, is known as “holding onto a losing position.” Some overseas FX traders may wait, believing that the exchange rate will eventually move back in their favor. However, while waiting, they cannot utilize their funds. Unless there’s a clear reason to wait, it’s generally not a good approach.

Before starting to trade, determine in advance at what level you will execute a stop-loss. Failing to set a stop-loss could lead to missing the opportunity to close a position, resulting in significant losses. If your stop-loss line is breached, close the position promptly to allow for the next trade.

Check Your “Position Ratio”

The forex market tends to move towards the side with the larger position ratio. For example, if the buy ratio is higher than the sell ratio, the chart will generally trend upwards. You can check the position ratio on the official website of the FX broker called “OANDA.”

Alternatively, use the “RSI” (Relative Strength Index) technical chart. When using RSI, a value above 50 indicates a higher buy position ratio, while a value below 50 indicates a higher sell position ratio. If the RSI is below 30, it is considered “oversold,” and if it’s above 70, it is considered “overbought.” RSI can also be used to identify trend reversals.

Align with “Market Movements”

When holding positions in overseas FX, it’s crucial to align as much as possible with market movements. No matter how calmly one can judge, emotions and hopes inevitably creep in during trading. Therefore, aligning with market movements is often more challenging than anticipated. When holding positions in overseas FX, aim to minimize subjectivity and focus on actual market movements.

Traders Who Strategically Build Positions Will Win!

This article discussed positions in FX. To trade in FX, you must establish a position. Establishing a position means buying and holding a position. While anyone can hold a position, it’s vital not to enter orders carelessly just because it seems easy. The positions you hold will largely determine your success or failure.

For example, holding a sell position during an upward market trend is likely to lead to losses. Trends typically continue unless there is a clear reason to change. If an upward trend is present, the correct action is generally to hold a buy position. Assess market movements and flows to choose appropriate positions.