Many people may find themselves in a situation where they “researched how to start overseas forex, but don’t know how to choose a currency pair.” Some might even want to start by learning “what types of currency pairs exist, and how the choice of currency pair impacts the trading results.”

There are various types of currency pairs, like combinations of “USDJPY” and “EURJPY,” each with distinct characteristics. Therefore, understanding the features of each currency pair as part of a trading strategy can be an efficient way to aim for profit. This article will explain which currency pairs beginners should choose, focusing on selection methods and examples of specific currency pairs.

What is a forex currency pair?

A currency pair is, as the name suggests, a pairing of two countries’ currencies. For example, the “USD/JPY” pair combines the US dollar and Japanese yen. In forex trading, it is not possible to trade single currencies like just the yen or the dollar. The forex system is designed so that profits or losses are derived from exchange rate differences between two currencies.

For instance, if you buy USD at 100 JPY and sell it at 110 JPY, you gain 10 yen. Conversely, if you sell at 90 yen, you incur a 10 yen loss. Therefore, selecting a currency pair is essential for trading.

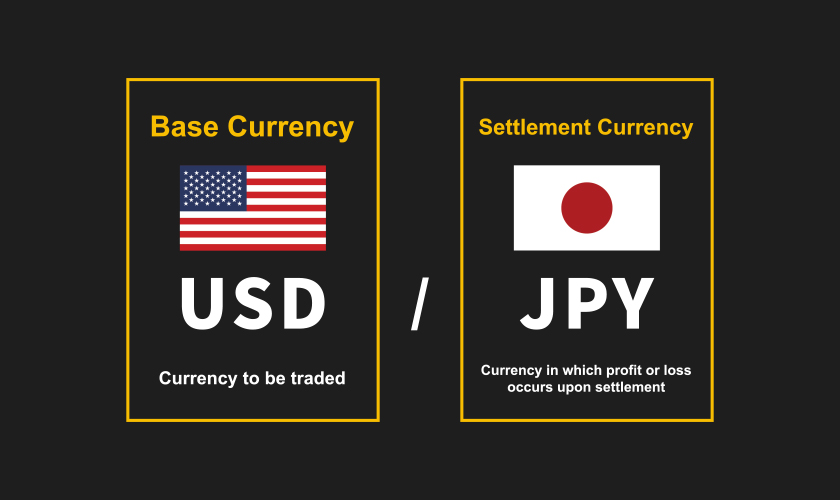

Base currency and quote currency

Two different currencies in a pair are divided into the “base currency” and “quote currency.” The currency on the left in the pair is the “base currency,” and the one on the right is the “quote currency.” For example, in the pair “USDJPY,” the US dollar is the base currency, and the yen is the quote currency.

In forex, the quote currency is used to buy and sell the base currency. “Buying USDJPY” means “selling yen to buy dollars,” and “selling USDJPY” means “buying yen and selling dollars.”

Example: If the base currency is USD at 120 JPY, and you buy it with 120 JPY, then sell at 130 JPY, you gain 10 JPY. Usually, your own country’s currency is used as the quote currency. For non-yen transactions, remember to use the stronger currency as the quote currency.

However, for beginners, transactions without yen may be more difficult and are not recommended.

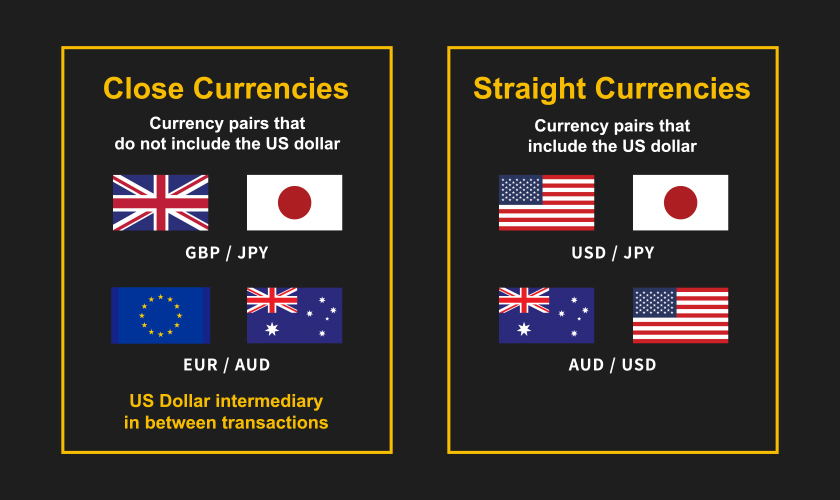

Straight and cross currencies

If you research forex, you may come across the term “straight.” Pairs with USD as the primary currency are generally called “straight currencies.”

Examples of straight currencies include “USDJPY,” “AUDUSD,” “EURUSD,” “GBPUSD,” and “NZDUSD.” USD is considered the most stable currency, making straight currencies easier for beginners to trade.

Pairs without USD are called “cross currencies” or “synthetic currencies,” like “EURAUD” or “GBPJPY.” These don’t include USD, thus called cross currencies.

In forex, however, there’s a rule that “USD must be involved in each trade.” When trading “GBPJPY,” for instance, you’re not directly buying pounds with yen; first, you buy USD with yen, then use USD to buy GBP. This two-step process is why it’s called cross currency.

Basic currency pair concepts

There are various currency pairs in forex, and selecting the right one is key for making a profit. Knowing basic currency pairs can also give beginners confidence in trading. Start by understanding the currency pairs available for smoother forex transactions.

Major vs. minor currencies

Currency pairs can be broadly classified as “major” and “minor.” Major currencies like USD and JPY have high trading volumes and are globally trusted.

Major currencies have a large trading volume and stable market prices. In addition, because of the large trading volume, they tend to have high liquidity and narrow spreads, making them easy for beginners to use.

Examples include USD, JPY, EUR, AUD, GBP, NZD, CAD, and CHF.

Minor currencies, also called exotic currencies, include South African Rand (ZAR) and Turkish Lira (TRY), with lower trading volumes and, thus, lower reliability. Others include Mexican Peso (MXN), Hong Kong Dollar (HKD), Singapore Dollar (SGD), and Chinese Yuan (CNH). There’s no strict definition for minor currencies, but generally, pairs not involving major currencies are considered minor.

| Major Currencies | Minor Currencies |

|---|---|

| Dollar (USD) | South African Rand (ZAR) |

| Yen (JPY) | Turkish Lira (TRY) |

| Euro (EUR) | Mexican Peso (MXN) |

| Australian Dollar (AUD) | Singapore Dollar (SGD) |

| Pound (GBP) | Chinese Yuan (CNH) |

| New Zealand Dollar (NZD) | Brazilian Real (BRL) |

Trading major currencies

For beginners, trading between major currencies is recommended as it is more stable. So what are the major currency pairs?

The US dollar, the euro, and the yen are known as the world’s three major currencies, and each currency pair can be said to be a classic currency pair. For example, trading the dollar/yen (USDJPY) is popular because the yen is considered safe. The euro/dollar (EURUSD) currency pair is actually the most traded currency pair in the world. The pound/dollar (GBPUSD) currency pair, known as the cable, has synchronized movements due to economic ties.

In addition to the major currency pairs, there are several pairs of major currencies, but the advantage of major currencies is that they are easy to trade because they have high liquidity and gradual price movements. In addition, it is easy for beginners to grasp the characteristics and the spread is narrow, which is a nice thing. However, this is also a disadvantage because in order to make a large profit, you need to increase the trading volume.

Trading Major and Minor Currencies

When trading currency pairs that include minor currencies, beginners need to be particularly cautious. Minor currencies are often less accessible in terms of information, which can lead to sudden fluctuations. This can result in volatile price movements, potentially causing significant losses that could threaten one’s financial stability.

For example, with combinations like “Turkish Lira to Yen (TRYJPY)” or “Hong Kong Dollar to Yen (HKDJPY),” understanding the political situation of the issuing country becomes crucial. In cases where a country’s strength is weak, it can be heavily influenced by other countries, leading to sudden economic changes.

Of course, when considering pairs involving minor currencies, it is generally acceptable to select currencies from countries where you have lived, frequently stayed, or have family and friends who can provide information.

Trading Between Minor Currencies

Generally, within domestic FX providers, there are few options for trading pairs involving only minor currencies. Additionally, trading “Major Currency × Minor Currency” pairs may be restricted by some providers. However, it is possible to find overseas FX providers that allow trading with minor currency pairs.

That said, minor currencies can exhibit significant volatility, and trading them involves very high risks. On the other hand, if you can effectively understand the economic conditions of the minor currency’s issuing country, the potential profits can be substantial.

However, trading minor currency pairs carries inherent dangers and requires a discerning ability, making it not advisable for FX beginners. Even if you are interested in minor currencies, it’s better to consider pairs with major currencies.

8 Points to Consider When Choosing Currency Pairs for Beginners

When engaging in FX trading, selecting the right currency pair is crucial. The choice of currency pair can significantly impact your profits or losses, so it’s important to consider which pairs to trade. However, without knowledge, this can be confusing. Here, we summarize eight key points beginners should keep in mind when selecting currency pairs.

Narrow Down Your Choices to a Few Pairs

In FX trading, domestic brokers typically offer between 20 to 50 currency pairs, while overseas brokers may offer over 100. With so many options, it might seem exciting to trade various pairs, but for beginners lacking knowledge, trading a wide range of currency pairs can be risky. If you spread your focus too thin, you may end up incurring losses across the board.

Start by narrowing your choices to one or two pairs and begin trading. It’s advisable to get accustomed to trading with popular major pairs that are considered beginner-friendly, gradually building your experience and knowledge.

If you’re still unsure about which pairs to choose, consider utilizing free demo trading to gain experience. This can help you find a trading style that suits you, whether that means trading 2 to 4 pairs or focusing on just one.

Trade with Major Currencies to Minimize Risk

For beginners, it’s advisable to choose pairs consisting of major currencies. This is because trading with major currencies tends to offer greater stability. Major currencies generally have high trading volumes and are less affected by events that may impact specific individuals or countries, which reduces risk.

Additionally, it’s easier for traders to establish a flow of buying and selling when they want to. Analyzing major currency pairs is also less daunting for beginners, allowing them to better understand price movements.

While short-term gains may be harder to achieve with major currencies, this stability also provides a form of risk management. If you’re uncertain about which currency pairs to select, starting with a major pair like USDJPY is a safe bet.

Choose Dollar Straight Pairs for Stability

As mentioned earlier, trading with dollar straight pairs, which include the stable US dollar, can provide peace of mind for beginners. The gradual fluctuations in these pairs reduce the risk of sharp changes that could lead to significant losses. In other words, there’s a good chance of making profits even in short-term trading.

The US dollar is a key currency in global trade, so it’s wise to pair it with other major currencies initially.

On the other hand, cross-currency trading involves transactions between other currencies via the US dollar. This requires researching three different currencies—USD, JPY, and the other currency—making it more challenging for beginners. If you’re struggling to decide on a currency pair, it’s best to start with dollar straight pairs.

Select Currency Pairs with High Trading Volumes

Choosing currency pairs with high trading volumes offers the advantage of relatively predictable price movements. High trading volume means many traders are making similar decisions, making it less likely for prices to be influenced by unexpected factors. This allows traders to fully enjoy the essence of FX trading—being able to “sell when you want to sell” and “buy when you want to buy.”

In contrast, pairs with low trading volumes can experience significant price fluctuations due to sudden factors, making them harder to predict. Therefore, it is generally advisable for beginners to select currency pairs with high trading volumes. Representative pairs with high trading volumes include USDJPY and EURUSD. Other pairs with high trading volumes are listed in the table below.

| Currency pairs with the highest trading volume (Unit: Billions of dollars) |

2016 | 2019 | 2022 | |||

|---|---|---|---|---|---|---|

| Volume | Share(%) | Volume | Share(%) | Volume | Share(%) | |

| USD / EUR | 1,172 | 23.1 | 1,581 | 24.0 | 1,706 | 22.7 |

| USD / JPY | 901 | 17.8 | 871 | 13.2 | 1,014 | 13.5 |

| USD / GBP | 470 | 9.3 | 630 | 9.6 | 714 | 9.5 |

| USD / AUD | 262 | 5.2 | 359 | 5.4 | 381 | 5.1 |

| USD / CAD | 218 | 4.3 | 287 | 4.4 | 410 | 5.5 |

source:Triennial Central Bank Survey of foreign exchange and Over-the-counter (OTC) derivatives markets in 2022

Choose Currency Pairs with Accessible Information

One important factor in selecting currency pairs for FX trading is the ease of information gathering. Trading between major currencies, such as the US dollar and the Japanese yen, typically presents fewer issues. However, when dealing with pairs that include minor currencies or when trading cross currencies via the US dollar, the ability to gather information becomes crucial.

FX trading involves currency transactions, but it is also influenced by the political situation and economic conditions of the issuing countries. Therefore, currencies from stable countries, such as the US dollar, yen, or euro, tend to have higher reliability due to the availability of information.

In contrast, minor currencies, which often have less visible political and economic conditions, carry higher risks. If you have lived in a particular country, that might mitigate the risk, but in general, it’s best to avoid countries where information is difficult to obtain.

Choose Currency Pairs with Narrow Spreads

In FX trading, the “spread” is a crucial factor. The spread represents the difference between the buying and selling prices set for each currency pair. Since the spread is a trading cost, a narrower spread is preferable, as it reduces expenses and makes it easier to achieve profits.

The width of spreads can vary slightly among FX brokers, so it’s essential to check the spreads for the specific currency pairs you plan to trade. However, it is generally observed that the USDJPY pair tends to have a narrow spread across most brokers.

In essence, the more liquid the currency pair, the narrower the spread tends to be, making it wise to choose pairs involving major currencies. However, since spreads can fluctuate with market conditions, it’s advisable to investigate whether your broker offers fixed or variable spreads before trading.

Check for Moderate Volatility

Volatility refers to the rate of price fluctuations, and in the context of FX trading, it is described as "high volatility" or "low volatility." The higher the volatility, the more the price moves, which can present significant profit opportunities if you manage to ride the wave effectively.

However, excessive volatility can lead to substantial losses, making it a disadvantage. Thus, while it is preferable for volatility to not be excessively high, some degree of movement is necessary to create profit opportunities. Therefore, it is desirable to find a balance of moderate volatility.

To successfully generate profits, it's important to identify which currency pairs exhibit volatility in the market. Analyzing daily price ranges, fluctuations by day of the week, and hourly price changes using charts can be beneficial. For example, the USDJPY pair typically has lower volatility.

Avoid Currency Pairs with High Swap Points

Swap points refer to the adjustments made for interest rate differentials between two currencies. Each currency pair has associated interest rates, and when the rates differ, the swap points are used for adjustment. For instance, when you deposit money in a bank, you receive interest at regular intervals.

In FX trading, similarly, if you hold onto a currency position, you can receive daily interest. Generally, holding a long position in a currency with a high interest rate allows you to receive profits the following day. Conversely, holding a short position will result in the interest being deducted, so caution is required.

However, swap points can vary by currency pair. If you are looking to receive a higher amount of swap points, one strategy is to select pairs consisting of minor currencies combined with other minor currencies.

Current Campaigns Here Recommended Currency Pairs for Beginners: Top 10 Ranking

Even if you gradually acquire basic knowledge about FX trading and currency pairs, many people still find it difficult to decide which currency pair to choose when it comes to actual trading. To assist beginners in starting their trading journey, we present a ranking of popular currency pairs.

No.1: USD/JPY (Dollar/Yen)

The most accessible pair for beginners to start trading is USD/JPY. This pair ranks first in the domestic FX market and second globally. The US dollar is the most familiar foreign currency for Japanese traders, making it less intimidating for newcomers.

It features minimal spreads with most brokers, and its price movements are generally stable. However, when trends do occur, they tend to last for a significant period, making it easier for traders. Additionally, it’s not limited to Japanese or Asian trading hours, enhancing its trading accessibility.

No.2: EUR/JPY (Euro/Yen)

Similar to the US dollar and Japanese yen, the euro is also a popular major currency. It is traded by all domestic FX companies, and its spreads are narrow.

The basic movements of EUR/JPY are similar to those of USD/JPY, but it generally shows slightly higher volatility. It also tends to create regular chart patterns, making it easier to analyze trends visually. While it is relatively stable, it does carry political risks due to issues in some of the member countries, so staying informed is necessary.

No.3: EUR/USD (Euro/Dollar)

The currency pair of euro and US dollar, excluding the Japanese yen, also exhibits stable price movements. However, it’s essential to note the declining trend of the euro; thus, it may be more reasonable to consider a "sell" position initially.

Since this pair does not involve the Japanese yen, trading activity peaks during European trading hours. If you're in Japan and prefer to trade, it’s manageable for those active in the evening or at night. The relationship between the two currencies often shows a tendency for one to rise when the other has a compelling reason.

No.4: AUD/JPY (Australian Dollar/Yen)

AUD/JPY is a currency pair that makes it easier to accumulate swap points. The Australian dollar is known for its high-interest rates and stability, making it a popular choice. However, it may not accumulate swap points significantly more than other pairs.

Nonetheless, it’s beginner-friendly, making it an excellent choice for those who want to familiarize themselves with earning swap points. After gaining experience, traders can consider trying other pairs.

No.5: NZD/JPY (New Zealand Dollar/Yen)

The New Zealand dollar is also a stable currency, making it a reliable pair with the Japanese yen. Trading the NZD instead of the AUD can be beneficial, but keep in mind that the NZD is susceptible to influences from Australia, which requires careful consideration before trading.

Historically known for high interest rates, the NZD has been experiencing a gradual increase in rates this year. Those with a reasonable amount of capital seeking larger profits may want to challenge themselves with this currency pair.

No.6: GBP/JPY (British Pound/Yen)

The British pound is known for its volatility. Compared to the US dollar or euro, the exchange rate for one pound to yen is generally higher. This currency pair has high volatility, making it challenging for inexperienced traders.

However, it offers the potential for significant profits, so it is advisable for beginners to get comfortable with it and then advance to this intermediate pair once they become more familiar with FX trading. Jumping in without being able to read charts may lead to losses due to sudden fluctuations.

No.7: GBP/USD (Pound/Dollar)

This pair represents the British pound against the US dollar. While the dollar is currently the world’s primary reserve currency, the pound once held that title. Known as "Cable," this currency pair ranks as the third most traded in the world.

It is characterized by stable price fluctuations without yearly extremes. It is also a highly volatile pair, with key trend lines being easily observed. Movements often begin around 16:00 to 17:00 when the London market opens.

No.8: EUR/GBP (Euro/Pound)

This pair involves the euro, which is popular as the second major reserve currency, against the British pound, which was previously a primary reserve currency. Both currencies are European, leading to a strong correlation between them.

However, due to specific events in Europe and the UK, fluctuations between the two currencies can occur frequently. The euro and USD have an inverse relationship, so negative news from the US tends to impact the euro's value.

No.9: XAU/USD (Gold/Dollar)

XAU/USD refers to the gold price in relation to the dollar and is a cash-settled contract. Unlike typical FX trading, this one focuses on gold. While the representation may vary among brokers, both refer to gold trading.

This pair is characterized by significant price movements, often maintaining long-term upward trends. Additionally, it tends to be sought after in times of crisis. For those holding long positions, even temporary declines can lead to potential gains when prices rise again.

No.10: AUD/USD (Australian Dollar/US Dollar)

According to the Bank for International Settlements (BIS), the AUD/USD pair accounted for 5.4% of daily trading volume in 2019. The Australian dollar's value is closely tied to its export commodities, such as iron ore and coal, which tend to decline in value, negatively impacting the AUD.

This pair can show long-term trends when a movement occurs. Historical charts demonstrate that it has consistently attracted a reasonable level of support. A lower US interest rate tends to strengthen the Australian dollar against the US dollar.

Trading and Recommended Currency Pairs

When beginner forex traders make their first trades, one of their main concerns is which currency pairs to choose. Especially for scalping, day trading, swing trading, and position trading, knowing which pairs are best can be crucial. Here, we'll introduce recommended currency pairs for each trading style.

Recommended Currency Pairs for Scalping

"Among the many currency pairs, the recommended ones for scalping are: USD/JPY (Dollar-Yen) EUR/JPY (Euro-Yen) EUR/USD (Euro-Dollar) GBP/JPY (Pound-Yen) It’s generally advisable to choose major currencies. Major currency pairs have high liquidity, making sudden fluctuations less likely."

Additionally, currency pairs that share similar regional characteristics, such as EUR/GBP, USD/CAD, and AUD/NZD, are also suitable for targeting small fluctuations. These pairs tend to move within a range, making scalping easier.

Recommended Currency Pairs for Day Trading

"For day trading, where trades are completed within a single day, the recommended currency pairs are: USD/JPY (Dollar-Yen) EUR/JPY (Euro-Yen) EUR/USD (Euro-Dollar) These three major currency pairs are characterized by narrow spreads, which help minimize losses during day trading. This means transaction costs are lower, making it easier for beginners to start trading."

Once comfortable, traders may consider trying pairs like the pound or Australian dollar.

Recommended Currency Pairs for Swing Trading

Swing trading, which aims for larger profits at significant price swings, allows for less frequent chart watching, making it suitable for busy individuals.

"Recommended pairs include: USD/JPY (Dollar-Yen) EUR/USD (Euro-Dollar) These pairs are stable and have high trading volumes, making them suitable for long-term trading. Major currencies tend to have less volatility compared to minor currencies, increasing the potential for long-term profits."

Recommended Currency Pairs for Position Trading

Position trading involves holding financial institution positions over a longer period to generate profit. Unlike day trading, this style focuses on long-term strategies.

"Suitable pairs for long-term holding include: USD/JPY (Dollar-Yen) EUR/USD (Euro-Dollar) These major pairs have high trading volumes and favorable swap points. While high-interest currencies can be attractive, they can also be more volatile compared to currencies like the dollar, so caution is necessary. It’s better to choose stable currency pairs for long-term holdings."

Three Currency Pairs Not Recommended for Beginners

While it’s important to know which currency pairs are recommended for beginners, it’s equally valuable to identify those that are not advisable. A common approach in forex is to start with easy-to-trade pairs and gradually raise the difficulty level. Here are three pairs to avoid as a beginner:

TRY/JPY (Turkish Lira-Yen)

The Turkish lira tends to be unstable compared to the dollar and yen. With low liquidity, it’s generally considered a risky pair. However, it also offers a high potential for substantial profits. Beginners may struggle to understand Turkey's economic situation and accurately interpret charts, making it advisable to avoid this pair.

For instance, while the dollar and yen may fluctuate by 1%, the Turkish lira might fluctuate by 7% in the same timeframe, highlighting its volatility.

ZAR/JPY (South African Rand-Yen)

Similar to the Turkish lira, the South African rand is not recommended. It offers higher interest rates compared to the yen, which can be attractive, as some brokers provide around 15 yen per day in swap points for a 10,000-unit buy position.

While it offers high profit margins relative to investment, it also poses significant risks of loss for minor currencies. Beginners should exercise caution with this pair.

RUB/JPY (Russian Ruble-Yen)

The Russian ruble, as its name suggests, is issued by Russia. It is currently affected by U.S. economic sanctions and fluctuating oil prices. The ruble has one of the highest swap rates among major currencies, with an interest rate of 4.50%.

However, it is crucial to remember that the ruble is heavily influenced by geopolitical factors involving Russia, particularly military conflicts with neighboring countries. Therefore, understanding the political situation is essential, making this pair not advisable for beginners.

Conclusion

Choosing the right currency pairs is crucial to avoid losses. When starting forex trading, one of the biggest concerns is which currency pairs to select. For beginners, it's generally recommended to narrow down to one or two major currency pairs with high stability and trading volume. Instead of chasing large profits with minor currencies, it’s advisable to focus on achieving smaller profits until you become more comfortable.

Additionally, among the ten recommended currency pairs for beginners, starting with the top three is a good strategy. Begin by testing pairs like USD/JPY without including minor currencies.