For beginners in Forex, terms like Lot, leverage, and pips can be confusing, but they are essential knowledge to grasp before starting. In particular, Lot is the unit of trading volume in Forex, used as 1 Lot, 0.1 Lot, etc., and is crucial for adjusting trading quantities to manage profits and losses. Additionally, leverage allows for large trades with a small margin, and pips are used to standardize different currency units, all of which relate back to Lots.

So, how much Lot should a beginner start with? Here’s a straightforward summary for newcomers.

What is “Lot”?

As briefly mentioned earlier, Lot is a unit of currency volume in Forex, meaning a bundle. It’s similar to everyday units like a “dozen.” Typically, one Lot is equivalent to 10,000 units of currency like yen or dollars. Actual trading occurs in Lot sizes, so trades cannot be made below the set minimum Lot size.

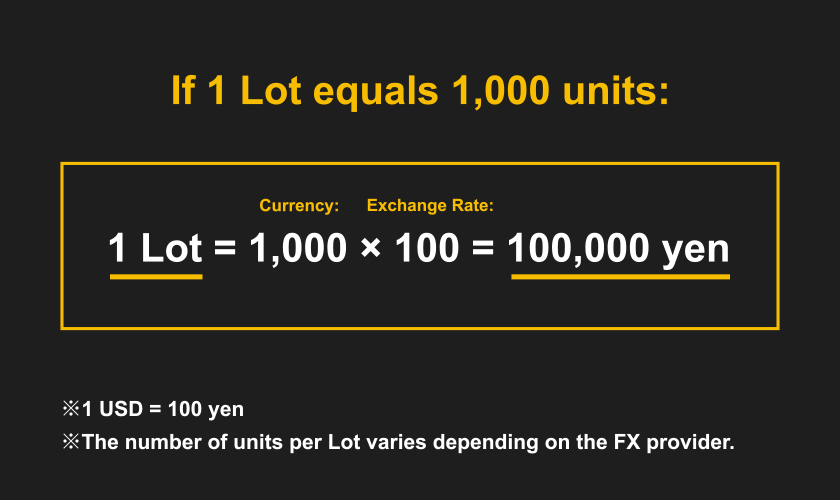

For example, if the exchange rate for 1 US dollar is 100 yen, consider a currency pair trading between the US dollar and Japanese yen.

In this case, if 1 Lot equals 1,000 units, then 1 Lot = 100 × 1,000 = 100,000 yen. When trading with a minimum of 1 Lot, the transactions will be conducted for amounts exceeding 100,000 yen. Naturally, increasing the Lot to 10 or 100 raises the trading amount.

In simple terms, increasing the Lot size can lead to higher profits, but it also results in higher risks. Conversely, lowering the Lot size reduces risk, but potential returns may also diminish.

The Reason for Using “Lot” as a Currency Unit

The reason Lot is used in Forex trading is to simplify transactions. Nowadays, with the advancement of the internet, it’s possible to engage in Forex trading from home, but this wasn’t the case in the past. Trading was typically done over the counter, and orders were placed via phone or paper.

Since Forex trades are made in larger amounts, such as 1,000 or 10,000 units, the number of zeros involved increases with the quantity traded, which can lead to mistakes. By using Lot as a standardized unit, the risk of order errors was reduced. Even today, when entering actual trades, it helps prevent mistakes related to zero entries.

Note: Lot Sizes Vary by Provider

In fact, the size of a Lot can vary among Forex service providers; for example, 1 Lot might equal 1,000 units or 10,000 units. Additionally, in overseas Forex, the unit of Lot can change depending on the type of account.

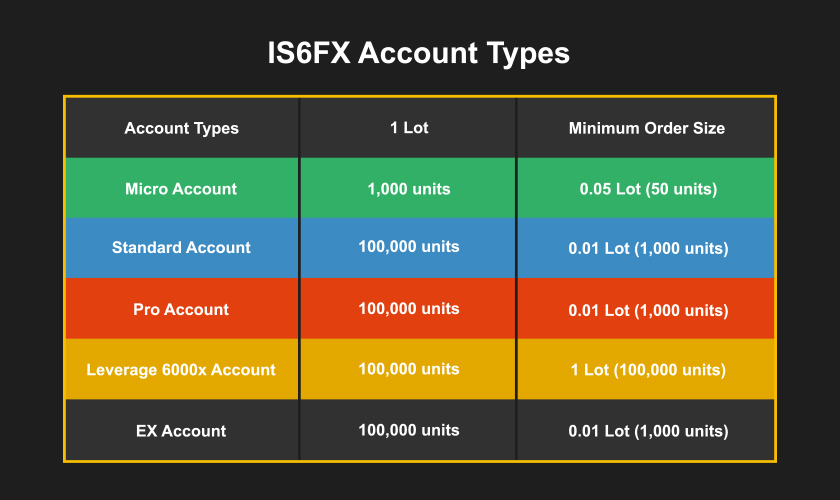

IS6FX offers five types of accounts: “Micro Account,” “Standard Account,” “Pro Account,” “6000x Leverage Account,” and “EX Account.” Only the Micro Account has 1 Lot equal to 1,000 units, while the others have 1 Lot equal to 100,000 units.

However, it’s also important to check the minimum order Lot size when selecting actual trades. For the IS6FX Micro Account, trading can start from 0.05 Lot (50 units). For the Standard, Pro, and EX Accounts, the minimum is 0.01 Lot (1,000 units), while the 6000x Leverage Account has 1 Lot equal to 100,000 units, allowing each trader to find the trading option that best suits them.

In Domestic Forex, “Mai” is Often Used as a Unit

While we discussed using Lot as a unit in Forex trading, in domestic Forex, the unit “mai” is often used. Both Lot and mai refer to the minimum trading unit, so the only difference is in terminology. For example, 1 mai = 1,000 units is equivalent to 1 Lot = 1,000 units.

When domestic Forex traders and overseas Forex traders communicate, it’s crucial to have a shared understanding that mai equals Lot, as confusion can arise otherwise.

The Relationship Between Lot and Leverage

An important aspect of Forex trading is “leverage.” Especially in overseas Forex, the ability to trade with high leverage is appealing. This leverage system allows those with limited capital to start trading and potentially generate significant profits, but without proper understanding, it can also lead to substantial losses. Here, we will explain the specifics of this mechanism, including basic knowledge and associated risks.

What is Leverage?

Understanding leverage is essential when starting Forex. Leverage is a system that allows you to control funds equivalent to dozens or hundreds of times your own capital, functioning similarly to the “lever principle” where a small object moves a larger one.

In simple terms, if you want to trade an amount worth 2.5 million yen, you would typically need 2.5 million yen, but with leverage, you can trade with less capital. For instance, with a leverage of 10 times, you can trade 1 million yen with just 100,000 yen.

However, leverage is not something you set up to trade; it is determined by adjusting the quantity traded in Lots. The specific calculation is done by dividing the current exchange rate multiplied by the quantity traded by the margin.

For example, if the reference exchange rate for trading is 100 yen to the dollar, and the quantity traded is 1,000 units with a margin of 10,000 yen, the leverage would be calculated as follows: 100 × 1,000 ÷ 100 = 10, meaning the leverage is 10 times.

What is Margin in Forex Trading?

Margin refers to the self-capital required as collateral when trading in Forex. To start trading, you need to deposit this margin as collateral. In reality, you don’t need to provide the entire trading amount from your own funds; by using leverage, you can aim for larger profits.

The amount of margin required for trading depends on the leverage used. The higher the leverage, the less capital you need to prepare as margin.

For example, if two traders achieve the same profit from the same trade, the trader with less margin will have a higher profit margin. This is the relationship between leverage and margin.

How to Calculate Required Margin per Lot

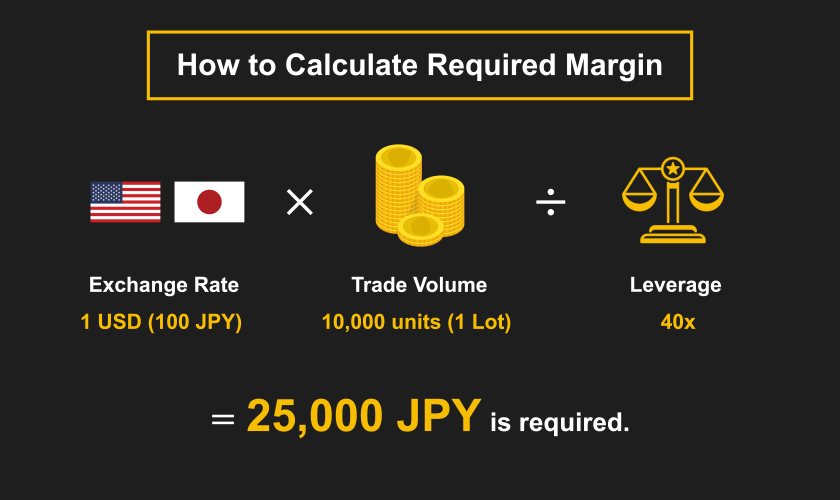

When actually trading, how do you calculate the required margin? The required margin amount can be calculated by dividing the desired trading amount (volume) by the leverage multiplier.

However, since the trading amount fluctuates based on the current exchange rate, the accurate formula is: Current Exchange Rate × Quantity Traded ÷ Leverage = Required Margin.

This calculation method can be used for both domestic and overseas Forex trading. For example, let’s assume a trading rate of 100 yen for 1 dollar, and you want to trade 10,000 units (1 Lot) with a leverage of 40 times. In this case, you do not need 1 million yen of your own capital; instead, you would need a margin of 25,000 yen, calculated as 100 × 10,000 ÷ 40. If the leverage were 100 times, the required margin would be just 10,000 yen.

In overseas Forex trading, the appeal often lies in the high leverage available, such as 100 or 1,000 times, resulting in lower required margins.

How to Calculate Usable Lot Size

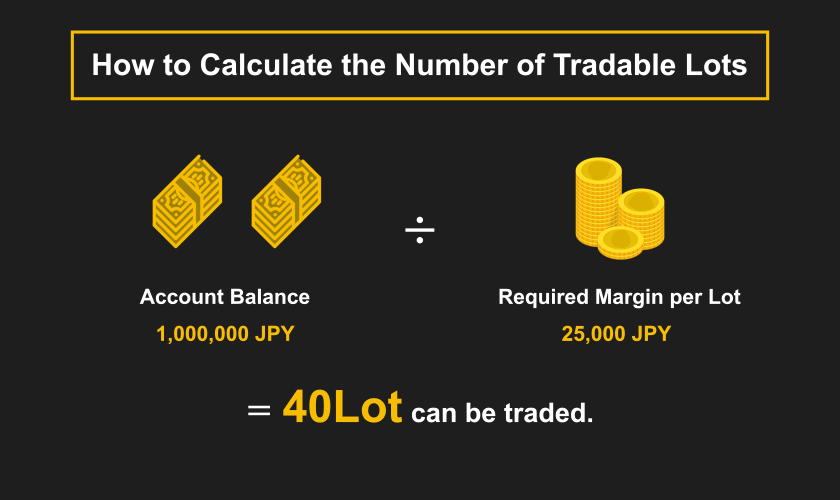

When starting trading, it’s also important to determine “how much trading is possible” in terms of lot size. To calculate the usable lot size, you use the required margin calculated earlier.

The specific formula is: Margin ÷ Required Margin per Lot.

Assuming a margin of 1 million yen, at a rate of 100 yen for 1 dollar, with 10,000 units (1 Lot) and a required margin of 25,000 yen, the usable lot size would be 1 million yen ÷ 25,000 yen = 40 Lots. This means you can trade 40 Lots in this case.

When starting overseas Forex trading, first decide how much capital you can prepare and what leverage you will use. This will give you a rough idea of the possible lot size for trading.

The number of lots that can be traded varies by Forex providers.

When starting overseas Forex, it’s crucial to know the possible lot size. Different providers have different settings for lot size, so if you want to maximize your profits, it’s better to choose a provider with a larger maximum trading lot size. Even within the same provider, different account types may have varying trading lot sizes.

For instance, as mentioned earlier, IS6FX offers a micro account where 1 Lot = 1,000 units, while for other accounts, 1 Lot = 100,000 units. The maximum order quantity for the standard account is 30 Lots, while the micro account has a maximum of 100 Lots. In contrast, Company A’s standard account has a maximum of 100 Lots, while Company B offers a maximum of 1,000 Lots with the same 1 Lot = 100,000 units.

The Relationship Between Lot and Pips

One of the fundamental terms to know in Forex is “pips.” Pips are essential knowledge in Forex trading, where various currencies like yen and dollars are traded. They are also necessary for confirming price movements and profit/loss.

What are Pips?

Pips, which stands for “percentage in point,” are used as a common unit in Forex trading. In Forex trading, various currency units are used, and using the original currency units can make it complicated to track fluctuations.

For example, if the U.S. dollar fluctuates by a certain amount, the Japanese yen by another, and the Australian dollar by yet another, it can be hard for many people to understand at a glance on the trading screen.

That’s where pips come into play. By expressing all currencies in pips, it becomes easier to recognize fluctuation ranges across different currency pairs. Additionally, you can express the difference between buying and selling prices in pips, allowing you to calculate total profit/loss based on the difference for each Lot traded.

How to Calculate Profit and Loss for 1 Lot Transactions

Using pips allows you to easily calculate the profit and loss from Forex trades. Additionally, the profit and loss will vary depending on the number of lots purchased when the exchange rate fluctuates. For example, when trading 1 lot (10,000 units) of USDJPY, a movement of 1 pip results in a profit or loss of 100 yen for 1 lot, 1,000 yen for 10 lots, and 10,000 yen for 100 lots. This demonstrates how the profit and loss vary based on the lot size.

Similarly, as the movement increases to 10 pips, 100 pips, or 1,000 pips, the profit and loss also become significantly larger. For a movement of 1,000 pips with 100 lots, the profit or loss could amount to a maximum of 10 million yen.

Recommended Lot Size for Beginners

How many lots should Forex beginners trade? Unfortunately, there is no clear answer to “how many lots are safe to trade.” This is because the appropriate lot size varies depending on the trader’s available capital, trading objectives, and mindset.

However, for those who would like a guideline, it is recommended to start by focusing on trading around 2% to 3% of your capital in lots. For instance, if you’re trading USDJPY with an FX provider where 1 lot equals 100,000 units and you have 1 million yen, you might start with 0.2 to 0.3 lots. If your capital is 100,000 yen, starting with 0.02 to 0.03 lots is advisable.

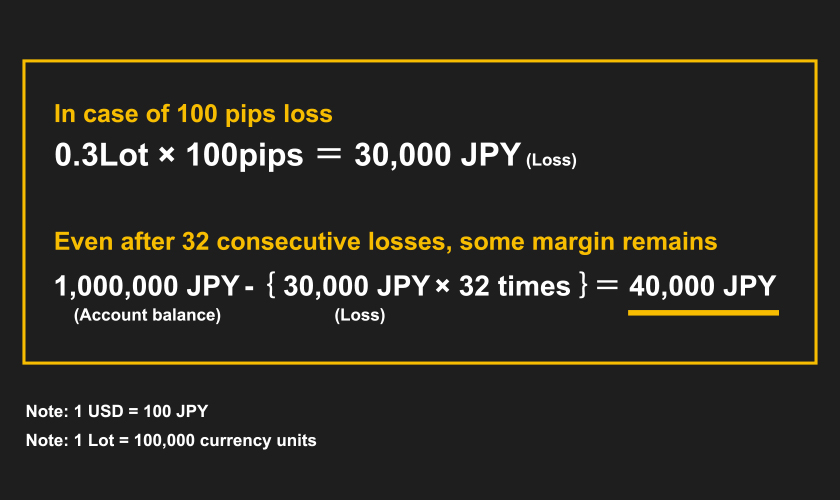

This translates to trading approximately 20,000 to 30,000 units. In the event of a trade at 0.3 lots resulting in a 100 pip loss, the loss would be only 30,000 yen. This means you could still make about 32 more trades while retaining some margin.

Benefits of Trading with Smaller Lots

Earlier, it was recommended that “Forex beginners should start with 2% to 3% of their capital,” which involves trading with smaller lots. Here, we will explain the specific benefits of reducing lot size.

1. Ability to Keep Losses Relatively Small

The first benefit of trading with smaller lots is that “you can keep your losses relatively small.” Generally, the more lots you purchase, the larger potential profits you can aim for. However, aiming for larger profits also means a higher possibility of incurring significant losses.

One common reason Forex beginners quit trading is that they aim for too much profit too quickly, leading to large losses. For beginners, it is more important to become familiar with Forex trading than to make profits right away. Therefore, until you gain more experience, it’s advisable to keep the lot size small and minimize the risk of loss as much as possible.

2. Ability to Trade with a Small Amount of Capital

The second benefit of trading with smaller lots is that “you can trade with a smaller amount of capital.” Naturally, when engaging in Forex trading, you need capital to purchase lots. The larger the lots, the more significant the capital required.

However, small lots can be purchased with just a few thousand to tens of thousands of yen. Therefore, even if you cannot prepare a substantial trading capital, it’s not an issue.

3. Ability to Trade Calmly

The third benefit of trading with smaller lots is that “you can trade calmly.” When the lot size is large, the fluctuating amounts can lead to a gambling mentality, making it difficult to make rational decisions.

For instance, you might think, “The rate should drop soon, but it must still go up. If it goes up, I could make hundreds of thousands,” and proceed with the trade based on unfounded assumptions.

Such trading can turn into gambling rather than investment, hindering your growth as a Forex investor. Conversely, when you trade with smaller lots, the gains and losses are smaller, allowing for calm analysis, such as, “Is this the right point to close the trade?”

Given this, beginners are encouraged to trade with smaller lots, as this approach increases the likelihood of developing as a Forex investor.

Lot Management = Risk Management

In trading, just like your trading style, lot management is crucial. Managing lots means managing the capital you have prepared, which ultimately leads to effective risk management. For beginners, the concept of lot management may seem challenging at first, but it is advisable to set rules from the beginning.

In trading, just like your trading style, lot management is crucial. Managing lots means managing the capital you have prepared, which ultimately leads to effective risk management. For beginners, the concept of lot management may seem challenging at first, but it is advisable to set rules from the beginning.