In FX trading screens, you’ll often see various types of “margin” displayed: “margin,” “required margin,” “effective margin,” and “excess margin.” Each of these is essential for FX trading, so it’s helpful to understand them. However, you may still wonder, “What exactly is margin?”

This guide explains the meaning and calculation methods of these four types of margin. It also covers related concepts such as “margin maintenance ratio” and “ways to avoid forced liquidation,” which are important to know if you want to minimize the risk of large losses.

What Is Margin in FX?

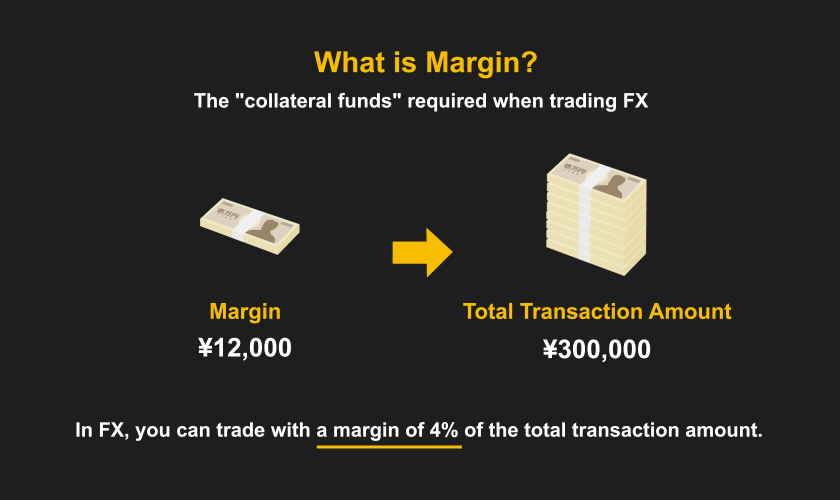

In FX, margin refers to the “collateral funds” required to make a trade. For example, imagine a trader who wants to make a 300,000 yen trade but only has 100,000 yen in their account. Typically, they wouldn’t be able to execute a trade of this size. However, in FX, as long as the trader has 4% of the total trade amount, they can proceed with the 300,000 yen trade. For a 300,000 yen trade, 4% equates to 12,000 yen, which is known as the “margin.”

FX is often described as something that “can be started with a small amount of money” and “offers the potential for significant profits with a modest investment.” This is possible because of this margin-based structure, allowing traders to engage in transactions relatively freely with an investment fund of around 10,000 to 100,000 yen.

What is Margin Maintenance Ratio?

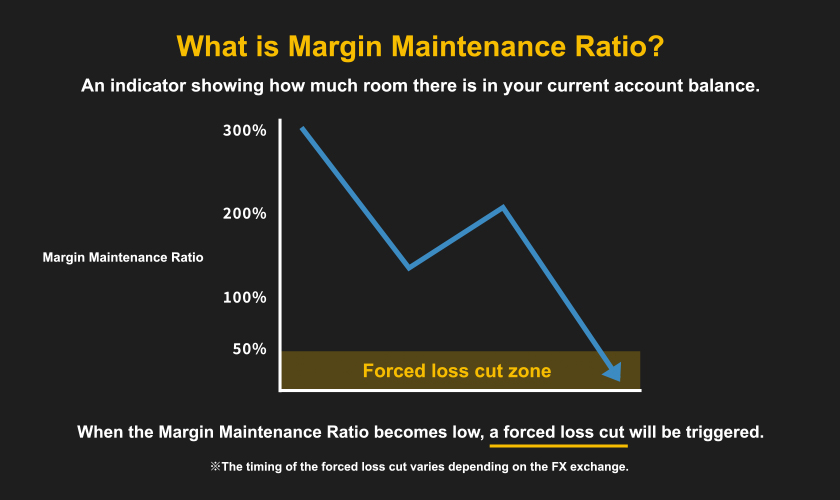

The margin maintenance ratio is an indicator of how much room there is in your current account balance. If the margin maintenance ratio becomes low, a forced loss cut will be triggered. A forced loss cut is a system that forcibly ends current transactions. The timing of when a forced loss cut is triggered will vary depending on the FX exchange you are using. For details, please check the official website of the FX exchange.

The margin maintenance ratio is an essential element for understanding your current trading situation. Check the ratio regularly to make sure your transactions are not risky. If you want to better understand the margin maintenance ratio, we recommend that you also remember the following terms.

・Effective margin: Total amount of margin available for trading

・Required margin: Funds invested in trading

How margin maintenance ratio works

The margin maintenance ratio is not always constant. It fluctuates depending on the amount of positions held and daily price movements. Keep the margin maintenance ratio as high as possible. It depends on the trader’s way of thinking and trading style, but it is recommended to maintain it at 100-200% or more.

If you want to trade more safely, keep it at 300% or more. If your margin maintenance ratio is getting low, try the following methods to raise the level.

・Add more money to your account

・Reduce the amount of positions held

・Hold both positions (hold both buying and selling positions in the same currency pair)

Calculation Formula for Margin Maintenance Ratio

The margin maintenance ratio can be calculated using the following formula:

Margin Maintenance Ratio = (Effective Margin ÷ Required Margin) × 100

For example, let’s say there is 300,000 yen in a trading account, with an unrealized loss of 50,000 yen. The calculation would be as follows:

¥250,000 ÷ ¥300,000 × 100 = 83

In this case, the margin maintenance ratio is 83%, which, being below 100%, indicates a somewhat risky trade. Conversely, if there were an unrealized gain of 100,000 yen, the calculation would look like this:

¥400,000 ÷ ¥300,000 × 100 = 133

In this situation, the margin maintenance ratio is 133%, which is above 100% and thus considered safe.

What is Required Margin?

What is Required Margin? Required Margin is the amount of money needed to purchase a position. For example, if you want to hold a position worth 500,000 yen, you need to prepare 500,000 yen (Required Margin). However, you don’t actually need to have that full amount ready. This is because of a system called “leverage,” which will be explained later.

By effectively utilizing leverage, you can conduct trades worth hundreds of thousands to millions of yen with just a few thousand to tens of thousands of yen in your account. Since you can trade FX with low risk, if you’re interested, you should definitely give it a try.

Formula for Calculating Required Margin

The required margin for FX trading can be calculated using the following formula:

Current Exchange Rate × Amount of Currency Purchased ÷ Leverage = Required Margin

For instance, if you purchase 10,000 units of USD/JPY at an exchange rate of 100 yen per dollar with a leverage of 25 times, the calculation would be as follows:

100 yen × 10,000 units ÷ 25 (leverage) = 40,000 yen

From this, you can see that you need to prepare 40,000 yen as the required margin to buy USD/JPY under these conditions. Additionally, when purchasing currency, you need to prepare the required margin regardless of whether it’s a buy or sell order.

Mechanism of Required Margin

The mechanism of required margin works as follows:

1. The FX company confirms the amount deposited as margin.

2. The trader borrows funds from the FX exchange.

3. The trader places an order to purchase currency.

4. The FX company calculates the required margin for the currency purchase.

5. (If the required margin is sufficient) Order completed.

6. (If the required margin is insufficient) Order rejected.

Required Margin and Leverage

In FX, you generally cannot purchase currency beyond the required margin, but by using leverage, you can buy currency exceeding the required margin. Leverage allows you to increase the trading amount based on the funds you have deposited as collateral. For example, if you attempt to purchase currency worth 1,000,000 yen with a margin of 100,000 yen:

Without leverage, this purchase would not be possible, but applying 10 times leverage makes it feasible. Thus, the calculation becomes:

1,000,000 yen ÷ 10 times leverage = 100,000 yen (required margin)

If you apply 100 times leverage, you can make a trade worth 1,000,000 yen with just 10,000 yen as the required margin. Although leverage also applies to losses, which can create a negative perception, it can also be a powerful tool to facilitate favorable trades. Therefore, make sure to utilize it effectively to maximize profits.

What is Effective Margin?

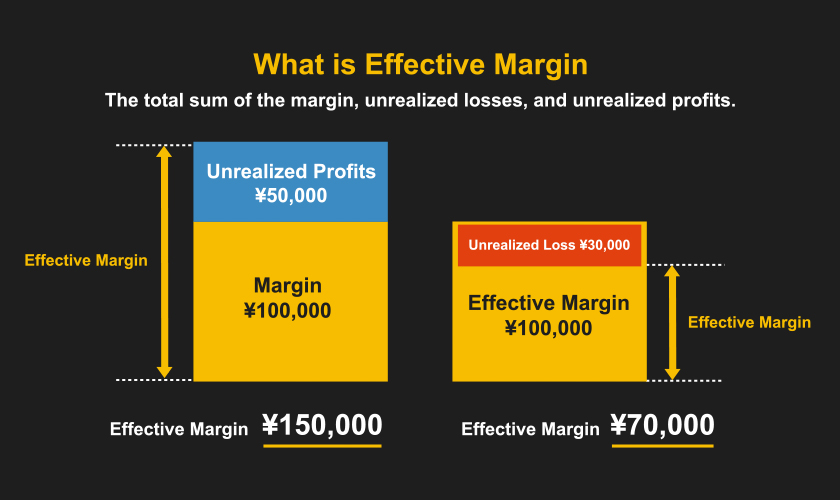

What is Effective Margin? Effective margin is the total amount of margin available for FX trading. To put it simply, it is the sum of your margin, unrealized losses, and unrealized gains. For example, if you have a margin of 100,000 yen and a profit of 50,000 yen, your effective margin would be 150,000 yen. If you have a loss of 30,000 yen, your effective margin would be 70,000 yen.

Some FX exchanges may refer to it as “real margin” or “net assets,” but all terms mean the same thing. Effective margin fluctuates constantly while you hold positions, so it’s important to regularly check both the margin maintenance ratio and the effective margin.

Calculation of Effective Margin (1) When No Currency is Held

When no currency is held, effective margin can be calculated using the following formula:

Margin + Profit and Loss Amount = Effective Margin

For example, if you have a margin of 100,000 yen and haven’t purchased any currency, there are no profits or losses. Thus, the profit and loss amount is 0 yen. In this case, the calculation would be:

100,000 yen + 0 yen = 100,000 yen

From the above condition, we see that the effective margin is 100,000 yen.

Calculation of Effective Margin (2) When Unrealized Gains Exist

When there are unrealized gains, effective margin can be calculated using the following formula:

Margin + Unrealized Gain Amount = Effective Margin

For example, if you have a margin of 100,000 yen and a profit of 70,000 yen, the calculation would be:

100,000 yen + 70,000 yen = 170,000 yen

Under these conditions, the effective margin would be 170,000 yen.

Calculation of Effective Margin (3) When Unrealized Losses Exist

When there are unrealized losses, effective margin can be calculated using the following formula:

Margin – Unrealized Loss Amount = Effective Margin

For example, if you have a margin of 100,000 yen and a loss of 20,000 yen, the calculation would be:

100,000 yen – 20,000 yen = 80,000 yen

In this case, the effective margin would be 80,000 yen.

Relationship Between Effective Margin and Margin Maintenance Ratio

The margin maintenance ratio quantifies the percentage of margin you are maintaining. Therefore, knowing your effective margin allows you to calculate the margin maintenance ratio. If the effective margin decreases, the margin maintenance ratio will also drop, which could trigger a forced liquidation (a function that forces the settlement of purchased currencies), so be cautious. The margin maintenance ratio can be calculated using the following formula:

Effective Margin ÷ Required Margin = Margin Maintenance Ratio

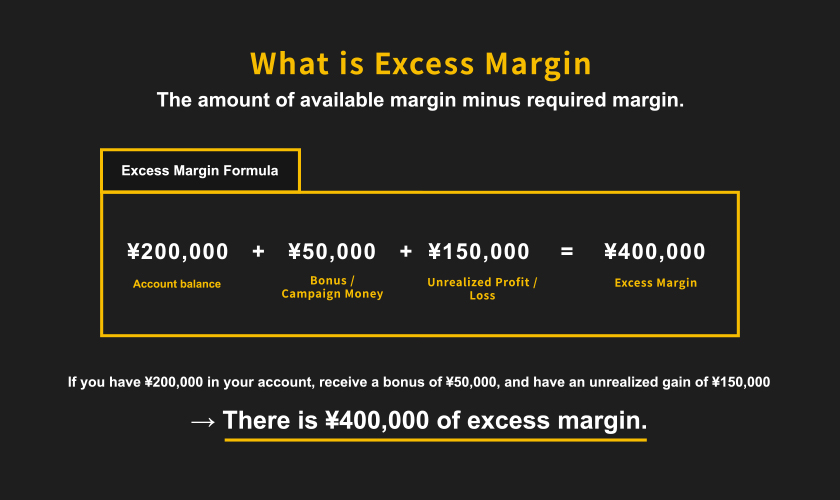

What is Excess Margin?

What is Excess Margin? Excess margin is the amount calculated by subtracting the required margin from the effective margin. It quantifies the available capacity in your current FX account, and as long as you have excess margin, you can place additional currency orders. Generally, having a surplus of excess margin indicates relatively safe trading, while having little or no excess margin signifies that you are engaging in high-risk trading.

Calculation of Excess Margin

Excess margin can be calculated using the following formula:

Account Balance + Bonus/Promotion Amount + Unrealized Loss/Gain = Excess Margin

For example, if you have 200,000 yen in your FX account and receive 50,000 yen from bonuses or promotions, and you currently have an unrealized gain of 150,000 yen, the calculation would be:

200,000 yen + 50,000 yen + 150,000 yen = 400,000 yen

This means that your excess margin is 400,000 yen.

Excess Margin and the zero cut System

Some FX companies implement a system known as “Zero Cut,” which nullifies any negative account balance without penalties if your balance goes negative.

Typically, the Zero Cut is executed when your account balance goes negative, but if your excess margin is positive due to bonuses or unrealized gains/losses, the Zero Cut will not be executed. If you’re worried that “the Zero Cut will not be executed even when my account balance is negative,” check to see if your excess margin is positive.

If Excess Margin Becomes Negative

You Will Be Unable to Purchase Currency If your excess margin becomes negative, you won’t be able to purchase currency. For example, if you only have 9,000 yen on hand, you cannot buy currency worth 10,000 yen. The simplest solution is to “deposit funds into your account balance.” If you deposit enough funds to raise your account balance to 10,000 yen, you can then purchase currency worth that amount.

Increased Risk of Loss Cut

If your excess margin becomes negative, the likelihood of a loss cut increases. Strictly speaking, a loss cut occurs when the margin maintenance ratio falls below a certain percentage, but excess margin and margin maintenance ratio are closely related.

When your excess margin decreases, your margin maintenance ratio also decreases. Therefore, to prevent loss cut, it is advisable to maintain a healthy level of excess margin.

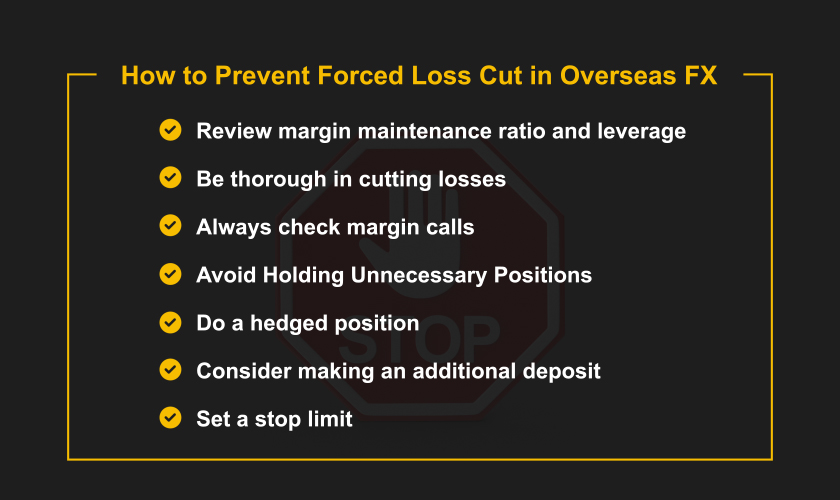

How to Prevent Forced Loss Cut in Overseas FX

When a forced loss cut is triggered, your account balance decreases significantly. Recovering from this situation can be difficult. Therefore, to succeed in FX trading, it’s essential to prevent forced loss cut. However, some people may not know how to do this. Here, we will introduce methods to prevent forced loss cut.

1. Review Margin Maintenance Ratio and Leverage

Leverage affects not only your invested capital but also your unrealized gains and losses. The higher the leverage, the more volatile your margin maintenance ratio can become. It’s not uncommon for it to change by nearly 100% within just a few minutes. Therefore, avoid using excessively high leverage.

For FX beginners, starting with leverage of 2 to 3 times is recommended. Simultaneously, focus on reviewing your margin maintenance ratio. If your margin maintenance ratio starts to drop significantly, consider adding more funds or closing positions.

2. Be thorough in cutting losses

A stop-loss order involves closing a position that is currently in an unrealized loss. While this may seem like a wasteful action, it is essential for successful FX trading. Stop-loss orders prevent you from incurring larger losses.

By disposing of positions that are unlikely to grow early on, you can minimize losses and protect your capital. Small losses can still provide opportunities to recover in future trades. For these reasons, utilizing stop-loss orders is a strategy with more advantages than disadvantages. Use them actively and without hesitation.

3. Always Check Margin Calls

A margin call is a notification that sounds when your margin maintenance ratio falls below a certain level. The threshold for triggering a margin call varies depending on the FX broker you are using. If you’re curious, check your broker’s official website.

If a margin call occurs, it suggests that your trading carries a certain level of risk, or that the market is experiencing significant fluctuations. In either case, it’s a high-risk situation, so urgently review your financial status and strategy. It’s advisable to reorganize your positions and reassess your leverage.

4. Avoid Holding Unnecessary Positions

Generally, the more positions you hold, the lower your margin maintenance ratio will be. Therefore, limit your entries to high-probability points and restrict the number of positions you hold. For FX beginners, it’s recommended to keep it to a maximum of three positions.

If you want to hold more than three positions, ensure they are all in unrealized profit. Holding positions in profit raises your margin maintenance ratio, reducing risk compared to holding them in loss. However, remember that favorable market conditions won’t last indefinitely. Be cautious and periodically consider reorganizing your positions.

5. Do a hedged position

Hedging refers to the strategy of holding both a buy and a sell position for the same currency pair simultaneously. For example, if you hold a buy position and a sell position of 1 lot each for USD/JPY, it is considered as having no net position: “1 lot – 1 lot = 0 lot.”

The margin maintenance ratio will revert to the value it was before holding the USD/JPY position, only deducting the unrealized losses. Use hedging when you want to seize opportunities with other currency pairs but lack the capacity to hold additional positions.

6. Consider making an additional deposit

An additional deposit, as the name suggests, involves depositing more investment funds into your FX account. Try simulating how recovery might occur. For instance, if your investment capital is 50,000 yen and you have an unrealized loss of 10,000 yen, your margin maintenance ratio is 80%. If you deposit 200,000 yen, your margin maintenance ratio will rise to 96%.

While additional deposits are a straightforward way to boost your margin maintenance ratio, there can be a delay of several days before the deposited funds are reflected in your account. Therefore, make deposits with some leeway.

7. Set a stop limit

As previously mentioned, cutting losses are vital to preventing forced loss cut. However, some people struggle with implementing them. In fact, many FX beginners fail to execute stop-loss orders effectively and end up exiting the trading scene. This is where “reverse stop-loss” comes into play. A reverse stop-loss is a type of order that executes a trade at a less favorable price than the one at which you initially ordered.

For example, if you purchase a currency at 100 yen, a stop limit would execute a sale at prices below 99.999 yen. Since it is a pending order, once set, it will automatically execute without further intervention. This helps mitigate the risk of sudden exchange rate fluctuations.

Summary

In this discussion, we’ve covered various aspects of “margin” that are essential for FX trading. Let’s summarize the key points:

Margin: The collateral required for FX trading.

Required Margin: The funds needed to open a position.

Effective Margin: The total margin available for FX trading.

Excess Margin: The amount remaining after deducting the required margin from the effective margin.

Margin Maintenance Ratio: An indicator of how much excess margin you currently have.

Each of these elements is crucial for FX trading. Take your time to gradually familiarize yourself with their meanings.